Who are Australia’s most prolific property Investors?

Almost 20 Per cent of Australia’s 11.4 million taxpayers own an investment property accoring to the Australian Tax Office.

Let’s look at the data:

71.5% of investors own one investment property.

18.8% own two.

and 9.7% own three or more properties.

With 19,895 taxpayers reporting they own six or more pieces of real estate.

About half of investors are aged under 50.

And a reported 52% of taxpayers with an interest in an investment property are men, and 48% are women

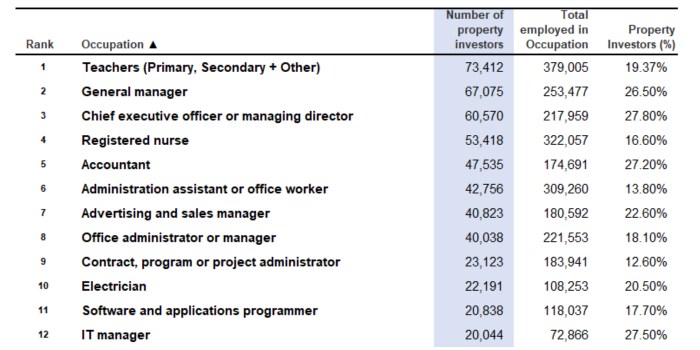

Notes: This chart is usually viewed as percentage of property investors per occupation, but instead we’ve sorted it by the number of property investors per occupation. Unclassified occupations have been removed and teachers have been grouped together.

This Data is from the 2019/20 Financial Year but is still relevant today. Source: AFR.com

Need content to share with your clients ?

We have a suite of resources for property managers and accountants including brochures, videos, pre-prepared emails and social media posts, that you can use to educate your owner-investors on the value of having a Tax Depreciation Schedule prepared.

For offshore or foreign investors, we even have content in Mandarin and Hindi available.

Depreciation applies to

Do you have a Depreciation Schedule in place for your Investment Property?

Depreciation is the accounting method used for calculating the loss in value of a building over time. You can claim this loss in value as a tax deduction in your annual tax return. Having a Depreciation Schedule in place is an essential part of any Investment Property strategy.

STANDARD RESIDENTIAL – $595 (inc gst)

Doesn’t my accountant look after that?

Only a qualified Quantity Surveyor can prepare a Depreciation Schedule. An accountant can order one for you, however this may take longer and end up costing more than if you had one already prepared.

Will this just be a new fee that I have to pay year after year?

A Depreciation Schedule lasts for the life of the property (40 years). You only have to pay one initial tax-deductible fee for the schedule, and then it is yours to provide to your accountant throughout the life of your property.

I’ve owned my investment property for many years without a Depreciation Schedule in place, is it too late to benefit now?

Not at all! A Depreciation Schedule can be used to amend up to two previous tax returns to recoup missing deductions. Now is the best time to order your Schedule – if you pay before June 30, you can claim the fee as a deduction in your tax return this financial year.

My investment property is a small apartment, surely there won’t be much to deduct?

Owners of apartments are able to claim Depreciation on a portion of the strata common areas.

You can claim depreciation on:

Bricks & mortar

Carpets & flooring

Toilets & showers

Air conditioning & solar panels

White goods

Electrical appliances

Door handles & garbage bins

Pools & pergolas

Strata common areas

Explore our 3D Virtual Tour to see some examples of deductions available to a brand new furnished 3x2 apartment:

Click and drag to explore different areas of the room

Blue items come under Capital Works (Division 43)

Green items come under Plant & Equipment (Division 40)

How does it work?

We conduct a thorough site inspection to assess the structure, fittings and furnishings at the property.

Our qualified Quantity Surveyors produce the schedule detailing your deductions for up to 40 years.

Your accountant applies these deductions to your annual tax return throughout the life of your property.